The Federal Government has directed all Ministries, Departments, and Agencies (MDAs) to submit statements of their accounts maintained in commercial banks, as part of efforts to enforce compliance with the Treasury Single Account (TSA) policy.

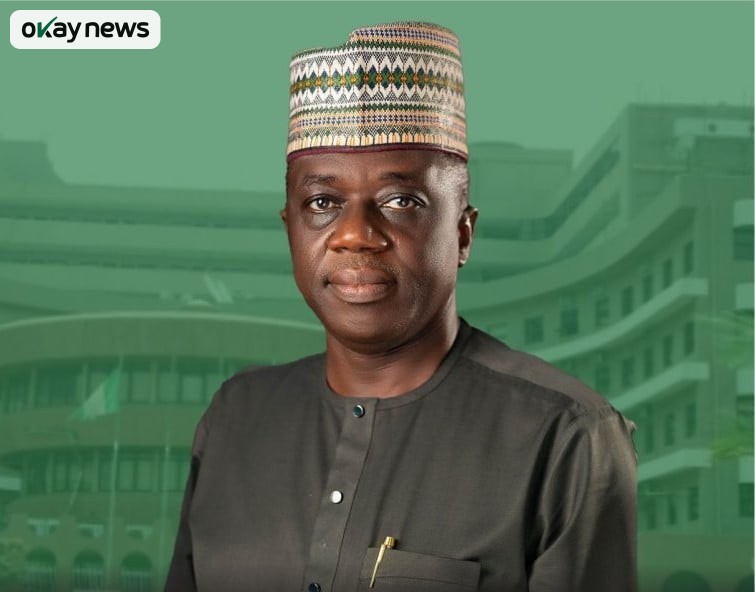

The directive, issued through a memo signed by the Accountant-General of the Federation, Shamseldeen Ogunjimi, followed reports that several MDAs were still operating bank accounts outside the TSA framework.

According to the memo, the continued use of commercial banks for government transactions violates existing circulars mandating the consolidation of all public revenues into the TSA domiciled with the Central Bank of Nigeria (CBN).

Ogunjimi said, “It has been observed with dismay that funds belonging to the Federal Government are still domiciled in several accounts held with commercial banks, contrary to Federal Government Circulars and the operational framework of the Treasury Single Account.”

He added that the Minister of Finance had directed all heads of finance and accounts in federal agencies to submit statements of all bank accounts — active, dormant, and closed — maintained in any commercial bank over the last six months. The statements must include account names, numbers, bank branches, and current balances.

The Accountant-General emphasized that the directive takes immediate effect and must be treated with urgency. He noted that the measure aims to strengthen fiscal discipline, ensure accountability, and uphold the integrity of the TSA framework.

The Federal Government first introduced the TSA policy to consolidate all revenues and receipts from MDAs into a single account at the CBN, reducing leakages and improving transparency in public finance management.

Despite earlier warnings, several agencies reportedly continued to operate accounts in commercial banks, prompting the renewed enforcement order.