As 2026 dawns, Olayemi Cardoso, governor of the Central Bank of Nigeria and his colleagues at the apex bank must no doubt be taking stock and reviewing the bank’s performance in 2025.

Some 12 months before, Cardoso was bemoaning the mess he and his team met at the CBN – severe macroeconomic distortions, surging inflation, evaporated FX liquidity, non-existent external reserves, weakened trust in economic management, unorthodox monetary practices that had eroded confidence and a foreign exchange market that was in paralysis with a backlog of over US$7 billion in unmet FX obligations undermining market integrity and the 60% spread between official and parallel market rates creating distortions.

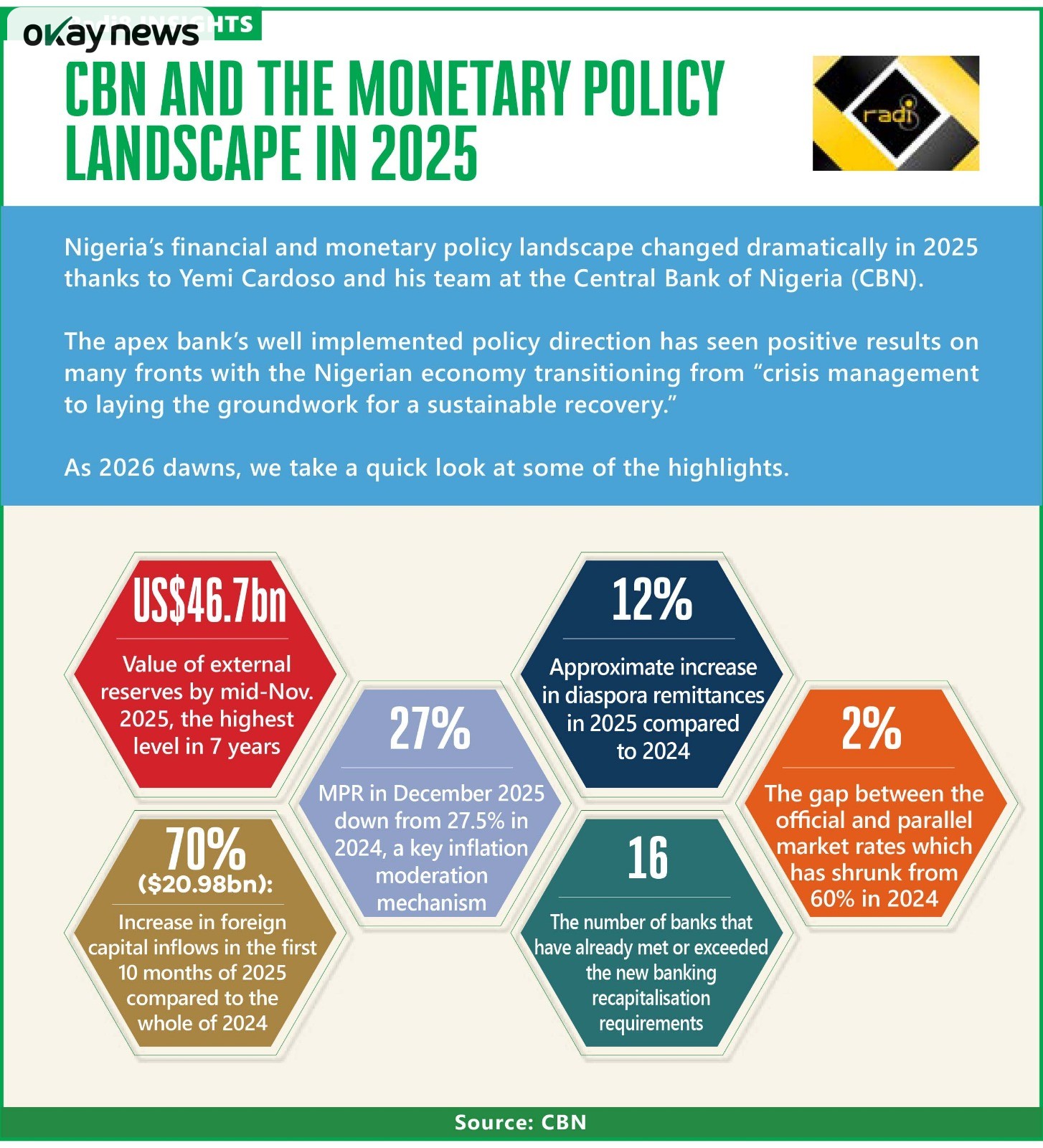

This year, the financial and monetary policy landscape has changed dramatically. A cursory consideration of the bank’s Monthly Update for December 25, 2025 reads like a catalogue of successes compared to the jeremiads of 2024.

And if anyone was in doubt as to progress made, the governor’s keynote at the CIBN annual bankers’ dinner on Friday, November 28, 2025 was not just five pages shorter than the 2024 speech it was also different in tenor. It was upbeat and optimist and no doubt a reflection of the positive mood that must permeate the CBN as 2025 ends.

For starters, the word “improved” appeared 24 times in the 14 pages. Hear him: “I am pleased to report meaningful progress on all three fronts, even as we remain fully aware of the work ahead. Our actions continue to reflect the policy direction we articulated from the outset, in other words, we said what we would do, and we have done it, transparently and consistently.”

That policy direction has seen positive results on many fronts in what Cardoso described as an economy that “has transitioned from crisis management to laying the groundwork for a sustainable recovery.”

The Nigerian economy grew by 4.23% in the second quarter of 2025, higher than the IMF/World Bank’s projection of 3.8% for sub-Saharan Africa. Inflation, while still in double digits, has dropped by over half from a peak of 34.6% in November 2024, to 14.45% in December reflecting over 7 months of consistent disinflation.

This, Cardoso noted, has not only restored “real purchasing power for households and businesses,” but has also borne out the apex bank’s insistence on a “disciplined execution and Nigeria’s return to orthodox monetary policy.”

While the Monetary Policy Rate (MPR), a key inflation moderating tool remains at 27%, Cardoso has noted that with the apex bank’s modelling pointing to continued disinflation in 2026, the policy rate will be calibrated in line with evolving data.”

Once the $7bn FX backlog was cleared, the CBN focused on reducing opacity, removing manipulation, and restoring discipline to the foreign exchange market in other to reap the benefits of the exchange rate unification. The result has been a huge contraction in the gap between the official and parallel market rates which has shrunk from 60% to 2% with the naira closing the year at N1,442.51 to the dollar.

The sanitisation of the foreign exchange market and strengthening of the naira was supported and buoyed in large part by the introduction of the Nigerian Foreign Exchange Code which established and insisted, according to Yemi Cardoso, on “clear rules for transparency, ethics, governance, and fair dealing among authorised dealers while the deployment of the Electronic Foreign Exchange Management System (EFEMS) system, powered by Bloomberg BMatch, has transformed FX trading through mandatory order submission, real-time regulatory visibility, and enhanced price discovery.”

The result? Market stability and enhanced investor confidence seen in a 70% increase (US$20.98 billion) in foreign capital inflows in the first ten months of 2025 compared to total inflows for 2024. For further context, the figure reflects a 428% surge compared to the US$3.9 billion recorded in 2023.

The improved conditions have also been evident in accretions in foreign reserves which grew from $40bn in November 2024 to a seven year high of US$46.7bn by mid-November 2025 “providing over 10 months of forward import cover and significantly enhancing the economy’s resilience.”

Cardoso was quick to point out that the increase has been organic. According to the CBN governor “what is most important here is that our FX reserves are being rebuilt organically, not by borrowing, but through improved market functioning, stronger non-oil exports, and robust capital inflows.”

While some analysts have remarked on the high proportion of foreign portfolio investments versus foreign direct investments regarding the foreign reserves, they seem to discount the contribution of diaspora remittances which increased by approximately 12% in 2025 thanks to the launch of the Non-Resident BVN in January.

Foreign capital inflows are expected to grow further in 2026 as awareness heightens around the Non-Resident BVN and as Nigeria begins to reap the benefits of its exit from the grey list of the Financial Action Task Force (FATF) following what Cardoso described as “a coordinated national effort led by the Federal Government, with critical contributions from the Central Bank of Nigeria, the Ministry of Justice, the NFIU, the EFCC, and our regional partners.”

Nigeria’s exit from the grey list, according to the apex bank governor “signals a major restoration of confidence and eases compliance frictions for correspondent banks” with tangible benefits of an estimated $30 billion in potential investment.

Three months to the end of the banking recapitalisation exercise, Cardoso has good news to share. The governor who had hinted during a Q&A session at the London Business School in October, that banks unable to meet the ongoing recapitalisation target may have to downgrade their banking licences, said the recapitalisation exercise is proceeding apace.

“I am pleased to report that several banks have already met the new capital thresholds, while others are advancing steadily and are well positioned to comfortably meet the March 31, 2026, deadline. To date…sixteen have already met or exceeded the new requirements – a clear testament to the depth, resilience, and capacity of Nigeria’s banking sector.”

While the CBN governor has presented his score card, one wonders whether the world is taking notice and Nigerians are feeling the effect of these improvements. Inflation wise, the price of a 12kg bag of rice hovered around N50,000 during the Christmas period down from over N80,000 to N100,000 in 2024. The downward trend has been reflected in other costs.

Rating agencies are clearly taking notice too, with Fitch, Moody’s, and Standard & Poor’s upgrading Nigeria’s ratings and acknowledging as Cardoso put it: “fundamentals are strengthening, reform credibility is rising, and Nigeria’s risk profile is improving. Fitch upgraded Nigeria from B- to B (stable), recognising our commitment to orthodox policies, including FX reform, monetary tightening, and ending deficit monetisation. Moody’s also raised its rating from Caa1 to B3 in May, citing improved fundamentals and a stronger outlook. And just this November, S&P affirmed B-/B and revised its outlook to positive, underscoring sustained reform momentum, rising reserves, and enhanced macroeconomic resilience.”

Because success has many fathers, Yemi Cardoso, who was named African Banker’s Central Bank Governor of the year 2025, must be looking for space to place the award plaques he and the bank have received this year.

So, is Cardoso in a celebratory mood? Has he and his colleagues put on their dancing shoes to celebrate? Well, anyone who thinks that Cardoso and his team will put their feet up and exult in these successes will be missing the point because as a wag once said the reward for hard work is more work.

Success invites adulation and in turn scrutiny. 2026 will be an important year for Cardoso and the apex bank he leads because a new year invites a reset and agenda setting.

He told his audience at the CIBN event that the agenda for 2026 is six-pronged: Strengthening the banking system, Delivering durable price stability, Modernising payments and promoting financial inclusion, Fostering responsible fintech innovation, Building institutional capacity and efficiency and Deepening partnerships and thought leadership.

Yemi Cardoso and his team have said what they will do but will there be hurdles on their path?

First, monetary policies require convergence with the fiscal side of things and come 2026, the CBN will need to manage fallouts from what is shaping up to become a controversial tax act. In the lead up to the January 1, 2026, implementation date of the new tax regime, banks are reporting large outflows of foreign currencies. It will be interesting to see the impact on our foreign reserves balance.

Secondly, elections are strange beasts with a voracious appetite for cash. Yemi Cardoso, as CBN governor has been bullish on autonomy, orthodoxy and a stubborn insistence on keeping the ways and means spigot fully shut having ended a N22.7trn Ways and Means advance in 2024. Will he be able to insist on that clear separation, in a manner of speaking, of town and gown or will he bow to pressure as the politicking season begins and places intense pressure on the fiscal and monetary sides of things?

Another key issue to keep in focus is security and how investors may perceive the American air strikes and the Federal Governments renewed battle against insurgency. Will there be more and what impact will it have on security and the economy? Wale Edun, Minister of Finance and coordinating Minister of the Economy has tried to calm verves with his op-ed where he noted that “far from destabilising markets or weakening confidence, such actions strengthen the foundations of peace” because “security and economic stability are inseparable; every effort to safeguard Nigerians is, by definition, pro-growth and pro-investment.” The CBN must evolve a strategy for keeping investors informed.

Finally, the MPR and inflation. An over 50% percent drop in inflation is cause for cheer but the target remains single digits. Cardoso has affirmed that “that is our goal in the medium term.”

The medium term is fast dawning and fans; sceptics and critics will be waiting to see how 2026 pans out.

***Toni Kan is a PR/Crisis Management expert and financial analyst