The Federal Inland Revenue Service (FIRS) has rejected allegations by former Vice President Atiku Abubakar that the Federal Government granted exclusive control of Nigeria’s national tax-collection infrastructure to a private firm, Xpress Payments Solutions Limited.

Okay News reports that the FIRS, in a statement issued by Aderonke Atoyebi, Technical Assistant on Broadcast Media to the Executive Chairman, said Atiku’s comments misrepresented the structure of Nigeria’s digital revenue system and risk politicising a routine administrative process.

Okay News reports that the agency clarified that it operates no single-gateway or monopoly arrangement, stressing that no private entity has exclusive rights over government revenue. Instead, Nigeria uses a multi-channel digital revenue system involving several Payment Solution Service Providers (PSSPs).

According to the statement, platforms currently approved under the digital revenue system include Quickteller, Remita, Etranzact, Flutterwave, and XpressPay, all functioning within what the FIRS described as a competitive and transparent ecosystem designed to simplify tax payments nationwide.

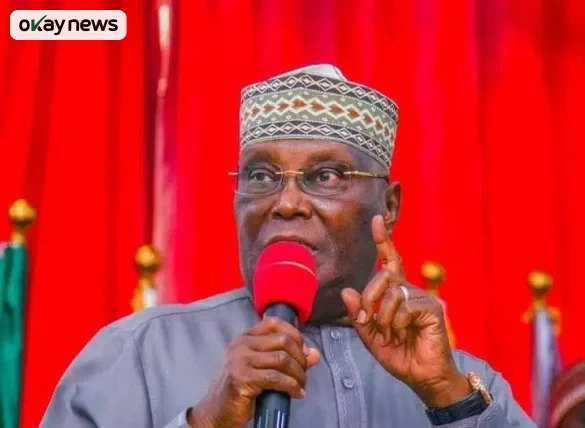

Okay News reports that Atiku Abubakar had earlier argued that appointing Xpress Payments as a collecting agent under the Treasury Single Account (TSA) framework mirrored what he called a “Lagos-style revenue cartel.” He warned that such a move could compromise transparency in the digital revenue system and concentrate influence in politically connected entities.

The former Vice President further criticised the appointment as lacking consultation, National Assembly engagement, or adequate stakeholder review. He claimed the decision introduced unnecessary private participation into core state revenue operations.

Okay News reports that the FIRS countered the allegations by emphasising that PSSPs do not control government revenue and do not earn percentages on collections. All payments go directly into the Federation Account, without diversion or intermediary custody within the digital revenue system.

The agency added that the expanded framework for PSSPs is part of ongoing tax reforms under the Presidential Committee on Fiscal Policy and Tax Reforms, a national initiative aimed at modernising Nigeria’s fiscal infrastructure in line with global standards.

Okay News reports that the FIRS insisted that onboarding of PSSPs follows a transparent process open to all qualified operators and should not be mischaracterised for political advantage.

The statement concluded by urging political actors to avoid spreading misinformation, saying the FIRS remains committed to professionalism, transparency, and strengthening Nigeria’s digital revenue system for the benefit of all citizens.