Moniepoint Inc. has announced a strategic alliance with Afrigopay Financial Services Limited (AFSL), a subsidiary of the Nigeria Inter-Bank Settlement System (NIBSS), to distribute five million AfriGO cards across the nation, a move poised to reshape Nigeria’s financial landscape. This collaboration aims to accelerate the adoption of Nigeria’s National Domestic Card Scheme, furthering the government’s ambitious digital payment agenda.

The partnership leverages Moniepoint’s extensive reach and robust infrastructure to promote tap-and-pay solutions, enabling seamless transactions via contactless cards and NFC-enabled devices. This initiative seeks to democratize access to financial services, particularly in underserved regions, aligning with the Central Bank of Nigeria’s (CBN) vision for a cashless society.

“This partnership is set to transform financial service delivery, particularly in underserved areas, by leveraging AfriGO’s innovative payment solutions,” stated Mrs. Ebehijie Momoh, Managing Director and CEO of Afrigopay. She highlighted the benefits of AfriGO cards, emphasizing “seamless transaction finalization and instant settlement, leading to improved efficiency, better cash flow management, and reduced risk” for merchants and agents.

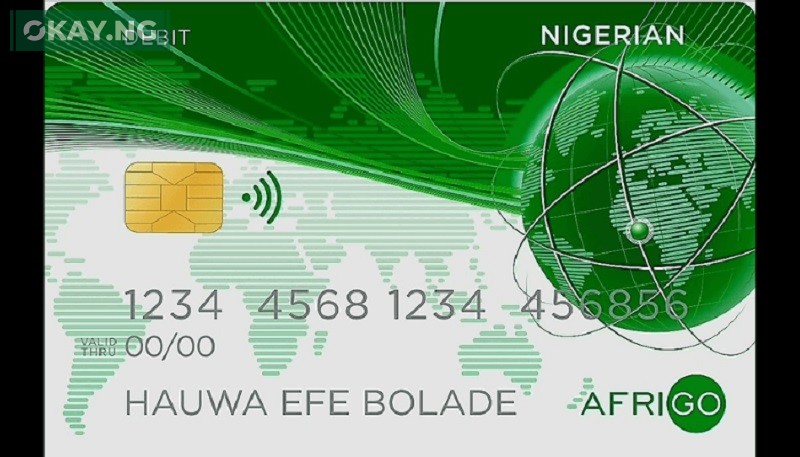

The AfriGO card, launched by the CBN in January 2023, aims to reduce Nigeria’s dependence on foreign exchange (FX) for payment transactions and ensure data sovereignty. As former CBN Governor Godwin Emefiele noted, the card was designed to address “local peculiarities that the existing card products have failed to cater to.” By creating a domestic alternative, Nigeria joins nations like China, Russia, and India in fostering a resilient and independent payment ecosystem.

Furthermore, Afrigopay’s partnership with the National Identity Management Commission (NIMC) to deliver a multipurpose card that integrates payment with national identity signifies a holistic approach to digital transformation. This integration promises enhanced security and convenience, streamlining various government and private sector transactions.

Read Also: CBN Digital Finance Inclusion, Cardoso Economic Policy, Nigeria Recapitalization

The implications of this partnership extend beyond immediate transactional benefits. By fostering a robust domestic payment infrastructure, Nigeria can mitigate the risks associated with reliance on foreign payment systems, bolstering economic resilience and national security. The potential for increased data sovereignty and reduced FX dependency is particularly crucial in today’s global economic climate.

From my perspective, this partnership is not merely a technological advancement; it’s a strategic move to empower local businesses and enhance financial inclusion. As Tosin Eniolorunda, CEO of Moniepoint Inc., articulated, “The benefits of contactless payments are far reaching and will be great for our ecosystem… we can reshape the digital economy so everyone — individuals, financial institutions, governments and businesses — can realize their ambitions.”

Imagine the small business owner in a remote village, now able to accept digital payments with the ease of a tap, improving their cash flow and expanding their customer base. Or consider the millions of Nigerians gaining access to formal financial services for the first time, fostering economic participation and empowerment.

In essence, the collaboration between Moniepoint and Afrigopay represents a significant step towards a more inclusive and technologically advanced financial future for Nigeria. By leveraging existing infrastructure and fostering innovation, this partnership aims to create a more equitable and prosperous economic landscape for all Nigerians.