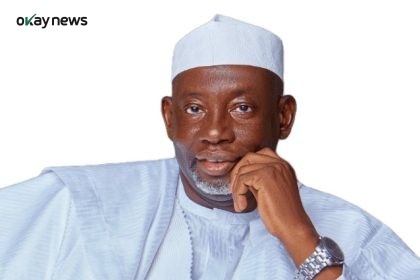

The Managing Director of the Nigerian Education Loan Fund, Akintunde Sawyerr, has clarified why the Fund is unable to pay institutional fees for new students until they have completed their registration processes.

In an exclusive interview with the News Agency of Nigeria in Abuja, Sawyerr noted that paying tuition for students who have not formally registered or matriculated could result in substantial financial losses for the Fund.

“If we pay fees for students who have not entered, what if they change their minds and do not go to the schools anymore? We cannot just say because somebody has been admitted to a school, and we will pay the fees before registering or matriculating,” he said.

According to Sawyerr, disbursing funds to students who have not completed registration constitutes disbursing against intention, a practice that carries financial risk for the government. “If we carry on like that, we could end up disbursing billions of naira, only to find out that they have dropped out, got admission to a school outside the country, gone to another school, or not doing that course again,” he added.

Another significant challenge, he said, is the requirement of a matriculation number by tertiary institutions before students can access the loan. To address this, the Fund is exploring temporary alternatives with schools, including the possibility of using students’ Joint Admissions and Matriculation Board registration numbers as substitutes for matriculation numbers.

“There are many genuine students who have applied, and they need a matriculation number to be able to process their fees. The challenge is that they cannot get their matriculation number until they have matriculated, and they cannot matriculate until they have paid. We are trying to work with the schools to see how those who have registered can use their JAMB registration number as a substitute,” Sawyerr said.

Reflecting on the Fund’s journey, Sawyerr recounted the early challenges following the establishment of NELFUND under the 2023 law. “One of the flaws was the requirement for a guarantor, which we saw as a difficult position to put students in. If you need a guarantor, it means that you need to go out and plead with somebody or pay somebody. The second was the 2023 Act stated that any family that had a household income in excess of N500,000 was not eligible. We all know that N500,000 is a very small amount of money for a household over a whole year. So, it meant that many people would not be able to apply for the loan,” he explained.

He also highlighted that the original law failed to provide for students’ basic upkeep after tuition payment. To remedy this, President Bola Tinubu initiated a repeal of the initial law, resulting in a new Education Loan Act launched in May 2024.

“From May 2024, when we started, and now, we are delighted that, not for a single day has the site crashed, even as we received unanticipated high demand. We have been able to receive applications on a steady basis, process them, pay students and their institutions from what has been allocated to us,” Sawyerr said, expressing gratitude to the President for visionary leadership.

Okay News reports that this initiative has become a vital support system for thousands of students who might otherwise have abandoned their education.