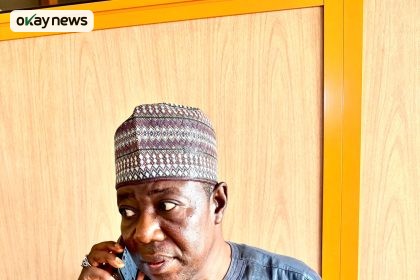

In a bold move that has ignited a national conversation on banking practices, former Aviation Minister Osita Chidoka is calling on Nigerians to open accounts with Sterling Bank this Friday, a direct response to their decision to abolish transfer fees. This action, dubbed #OpenSterlingAcct Day, is a clear signal of growing consumer discontent with what many perceive as exploitative banking practices.

Sterling Bank’s announcement on X (formerly Twitter) declared the removal of all charges for mobile app, online, and interbank transfers, as well as ATM card issuance. “That’s RIGHT! As of TODAY: Sterling Bank will NOT take any money for itself,” they stated, framing their decision as a stand against the rising financial pressures faced by Nigerians.

Chidoka, in a statement released Thursday, praised Sterling Bank’s move, highlighting the financial sacrifice involved. “They walked away from N13.56 billion in transfer charges—4.13 per cent of their total revenue—to give Nigerians breathing room,” he noted. “Other banks could, too—but they won’t.”

This decision by Sterling Bank stands in stark contrast to the substantial revenues major Nigerian banks accrue from transfer fees. Chidoka pointed out that Zenith Bank, GTCO, UBA, and First Bank collectively earned a staggering N186 billion from these charges in 2024. To put this into perspective, he stated, “For context, N186 billion is more than the combined federal allocation to six federal universities—UNN, ABU, UI, OAU, Unical, and Unilag—in the 2025 budget. It is also about 60 per cent of the entire budget of Yobe State.”

Analyzing the potential impact of fee removal, Chidoka argued that it would hardly dent the revenues of these major institutions. “GTCO: N15.47 billion from transfer charges—just 1.22 per cent of revenue. UBA: N48.36 billion—1.52 per cent. Zenith Bank: N80.05 billion—2.02 per cent. First Bank: N42.55 billion—1.41 per cent. These aren’t make-or-break figures for any of them. They’re just comfortable profits from charging ordinary Nigerians N10 to N50 per transfer—millions of times over,” he explained.

Read Also: Sterling Bank Breaks Ground: Abolishes All Local Digital Transfer Fees

This issue resonates deeply with many Nigerians struggling with the rising cost of living. The continuous erosion of disposable income by seemingly small, yet cumulatively significant, bank charges has fueled public frustration.

Chidoka’s call to action is a direct challenge to the status quo. “If banks won’t change, we must change banks. If regulators won’t act, we must act with our wallets,” he asserted. His initiative seeks to empower consumers to make informed choices and reward financial institutions that prioritize their well-being.

The former minister also emphasized the need for regulatory intervention, urging the Central Bank of Nigeria to address the issue of excessive bank charges. However, he also stressed that consumer action can be a powerful catalyst for change.

Sterling Bank’s decision has reignited a crucial debate about the fairness and sustainability of current banking practices. As Nigerians grapple with economic hardships, the spotlight is now firmly on financial institutions to re-evaluate their policies and prioritize the needs of their customers.