United Bank for Africa Plc (UBA) has reported gross earnings of N2.47tn for the nine months ended September 30, 2025, representing a marginal increase from N2.40tn recorded in the corresponding period of 2024.

The group’s unaudited financial statement filed with the Nigerian Exchange Limited on Thursday showed that profit after tax rose slightly by 2.3 per cent to N537.5bn from N525.3bn posted in the same period last year.

Interest income grew to N1.98tn from N1.80tn in 2024, driven mainly by higher earnings from investment securities and customer loans. However, interest expenses also rose to N808.7bn compared to N695.6bn in the prior period, reflecting the impact of higher funding costs.

UBA’s total assets increased to N32.49tn as of September 2025, up from N30.32tn recorded in December 2024, while shareholders’ funds grew to N4.3tn from N3.4tn. The bank’s total operating expenses stood at N846.1bn, slightly higher than the N812.2bn reported a year earlier.

The group also reported a 9.8 per cent increase in retained earnings to N1.77tn, reflecting continued profit retention and balance sheet expansion across its African and international operations. The growth in retained earnings demonstrates the bank’s capacity to reinvest profits while maintaining operational stability.

In the period under review, the group was involved in 1,766 legal cases compared to 1,703 in 2024, with total claims estimated at N942bn, lower than N1.325tn in the previous year. According to the directors, after seeking professional legal advice, no significant liability is expected to arise from these cases beyond the provisions already made in the financial statements.

The group engages in normal banking business activities involving acceptances, performance bonds, indemnities, guarantees, and letters of credit. In compliance with banking regulations, total commitments and contingent liabilities stood at N158m during the review period.

United Bank for Africa Plc declared a free float percentage of 84.36 per cent, with a free float value of N1.495tn as of September 30, 2025. This confirms the bank’s compliance with the Nigerian Exchange Limited’s Premium Board requirements, which mandate minimum free float thresholds for listed companies.

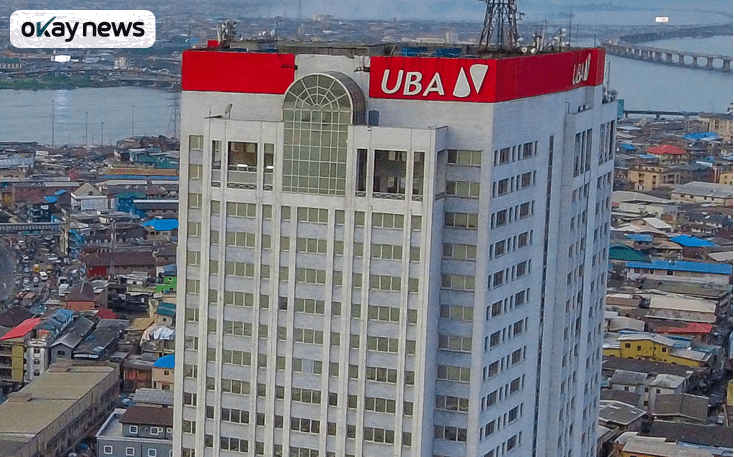

United Bank for Africa Plc operates as one of Nigeria’s largest financial institutions with operations spanning multiple African countries and international markets, providing commercial banking, corporate finance, and retail banking services.