In a bid to strengthen the capacity building between the Nigerian Federal Inland Revenue Service (FIRS) and the United Kingdom’s His Royal Majesty’s Revenue and Customs (HMRC), a Memorandum of Understanding (MoU) was signed yesterday in London.

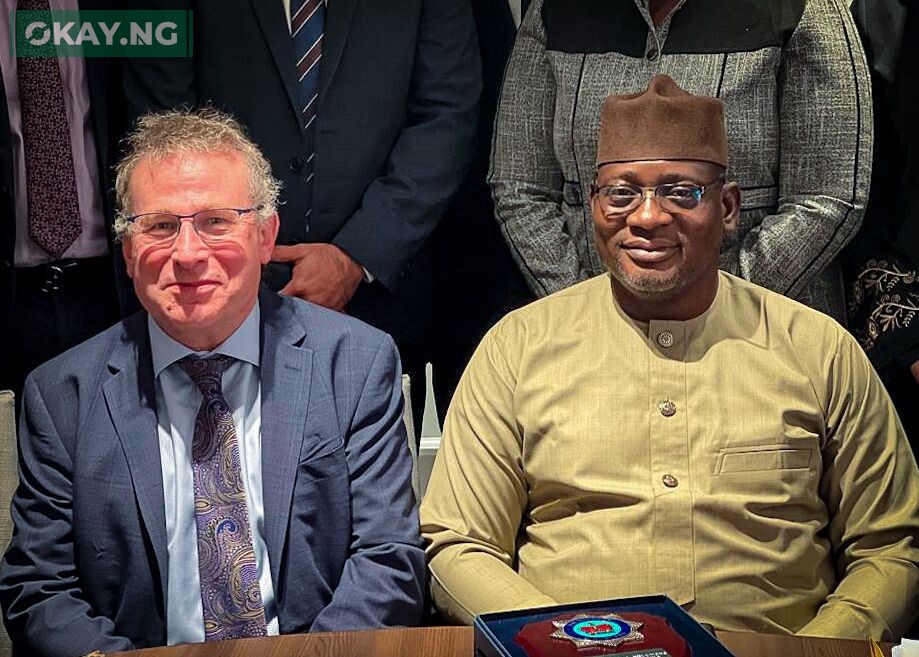

The agreement signing was witnessed by the Executive Chairman of FIRS, Mr. Muhammad Nami, accompanied by some members of the Board and management, and Director at HMRC, Jon Sherman, alongside other members of the HMRC Executive Committee. The primary objective of the MoU is to enhance cooperation between the two tax authorities.

Speaking on the collaboration, Mr. Muhammad Nami stated that the relationship with HMRC is in line with two key aspects of his cardinal goals for the FIRS, which are building a data-centric tax authority and improving collaboration and stakeholder relations. Mr. Nami also emphasized the significance of data collection, interpretation, and its application for tax purposes, which is crucial for the FIRS to stay ahead of the taxpayers in the current times.

“We must be a step ahead,” Mr. Nami noted, adding that the MoU would equip the officers of FIRS with the skills of the 21st-century tax man. He further explained that this collaboration would help improve tax revenue collection, providing the Nigerian government with the resources needed to cater for the people.

David Yellowly, Head of Capacity Building at HMRC, also commented on the MoU. He emphasized that the two countries would collaborate on capacity building, especially on issues related to Country-by-Country Reporting Standards, Transfer Pricing, Exchange of Information, Data, and Audit in the Oil and Gas industry.

As the President of the Commonwealth Association of Tax Administrators (CATA), Mr. Muhammad Nami has engendered numerous collaborative efforts with tax authorities both domestically and globally, in line with his agenda of improving stakeholder relations for improved tax administration.

In February this year, FIRS also signed an MoU with the Lagos State Inland Revenue Service (LIRS) for collaboration on Joint Tax Audit, Exchange of Information, and Capacity Building.

The FIRS and HMRC’s agreement is expected to enhance capacity building and promote improved tax administration in Nigeria, further supporting the government’s revenue generation efforts.