Nigeria’s Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has firmly dismissed circulating claims that Nigerian bank accounts will be frozen or automatically debited beginning from January 2026, describing the reports as false, misleading, and unsupported by law.

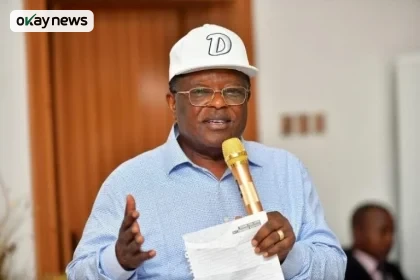

Oyedele, who leads the federal government committee responsible for shaping Nigeria’s ongoing tax and fiscal reforms, addressed the issue on Tuesday through a public statement shared on his verified account on X, formerly known as Twitter. He warned Nigerians against falling victim to fear-driven narratives surrounding the new tax laws.

“Don’t let anyone manipulate you. Your bank account is safe. Misinformation makes you panic and fear a reform that is designed to help you. When they tell you that your account will be frozen or automatically debited from January 2026, ask them for the evidence in the new law. Be wise,” Oyedele stated.

Okay News reports that the clarification comes amid growing public concern over Nigeria’s recently enacted tax reform laws, which are scheduled to take effect on Thursday, January 1, 2026. The reforms, approved by Nigeria’s National Assembly, have generated intense debate across the country, particularly on social media platforms where unverified claims have spread rapidly.

According to Oyedele, there is no section within the new tax laws that grants the federal government or any financial authority the power to freeze personal or corporate bank accounts without due process. He explained that such claims are part of a broader misinformation campaign aimed at undermining public confidence in fiscal reforms.

The committee chairman also addressed allegations that the tax reform laws were secretly altered after their passage by the National Assembly, Nigeria’s federal legislature responsible for making laws. He described such allegations as baseless, insisting that the legislative process was transparent and consistent with constitutional procedures.

Oyedele further clarified that provisions such as the requirement for a Tax Identification Number for certain financial and commercial transactions are not new. He explained that similar requirements already existed under previous legislation, including the Finance Act of 2019, and that the new laws merely strengthen existing regulatory frameworks rather than introduce automatic deductions or punitive account restrictions.

He urged Nigerians to rely on information from official government sources and credible institutions, rather than unverified online commentary, warning that fear-based misinformation could weaken public trust and stall economic reforms intended to stabilize Nigeria’s fiscal system.

As Nigeria continues to pursue tax reforms aimed at broadening revenue collection and improving economic governance, government officials maintain that transparency and public education remain critical to the success of the reforms.