Johannesburg, South Africa – South Africa’s annual inflation eased to 3.5 percent in January, edging closer to the central bank’s 3 percent target and bolstering expectations for an interest rate cut when policymakers meet next month.

Okay News reports that consumer prices rose 3.5 percent year-on-year, compared with 3.6 percent in December, according to Statistics South Africa data released on Wednesday. The reading came in slightly above the median estimate of 3.4 percent forecast by economists in a Bloomberg survey. On a month-on-month basis, prices increased 0.2 percent.

The outcome strengthens the case for the South African Reserve Bank’s Monetary Policy Committee to lower borrowing costs at its March 26 meeting. The MPC left the benchmark rate unchanged at 6.75 percent in January, with a 4-2 split vote revealing internal division over the decision. The central bank’s quarterly projection model continues to factor in two rate cuts for 2026, followed by one further cut in 2027.

Several factors support the easing outlook. The rand has gained more than 3.7 percent against the dollar this year as gold and platinum—key exports—have rallied. Oil prices are averaging about $61 per barrel, $4 less than the central bank’s 2026 assumption. Of the 14 economists surveyed by Bloomberg this month, a majority expect policymakers to lower borrowing costs next month by 25 basis points.

However, risks remain. Meat prices have surged due to an outbreak of foot-and-mouth disease in cattle and are likely to remain elevated in the near term, according to Paul Makube, a senior agricultural economist at First National Bank. Electricity pricing uncertainties also persist, with a potential correction of a calculation error by the energy regulator that could lead to higher tariff increases.

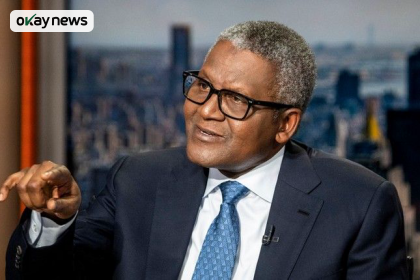

The central bank lowered its inflation target to a point of 3 percent with a tolerance band of plus or minus 1 percentage point in late 2025, replacing the previous 3-6 percent range. Governor Lesetja Kganyago has emphasised that while the band provides flexibility, the objective remains to achieve 3 percent inflation over time.

Despite easing inflation, South Africa’s economy faces structural challenges. Unemployment stands at 31.9 percent, with youth unemployment exceeding 46 percent, highlighting persistently weak absorptive capacity across sectors. Growth is projected at around 1.5 to 2.0 percent for 2026, supported by stronger commodity prices and improved consumption.